Next Speaker of the Day in @ias_summit: Shashank Mahajan from Value Educator @ValueEducator Company Name : Z-tech India Ltd Sector: Theme Park Market Cap: 863 Cr #IAS2025

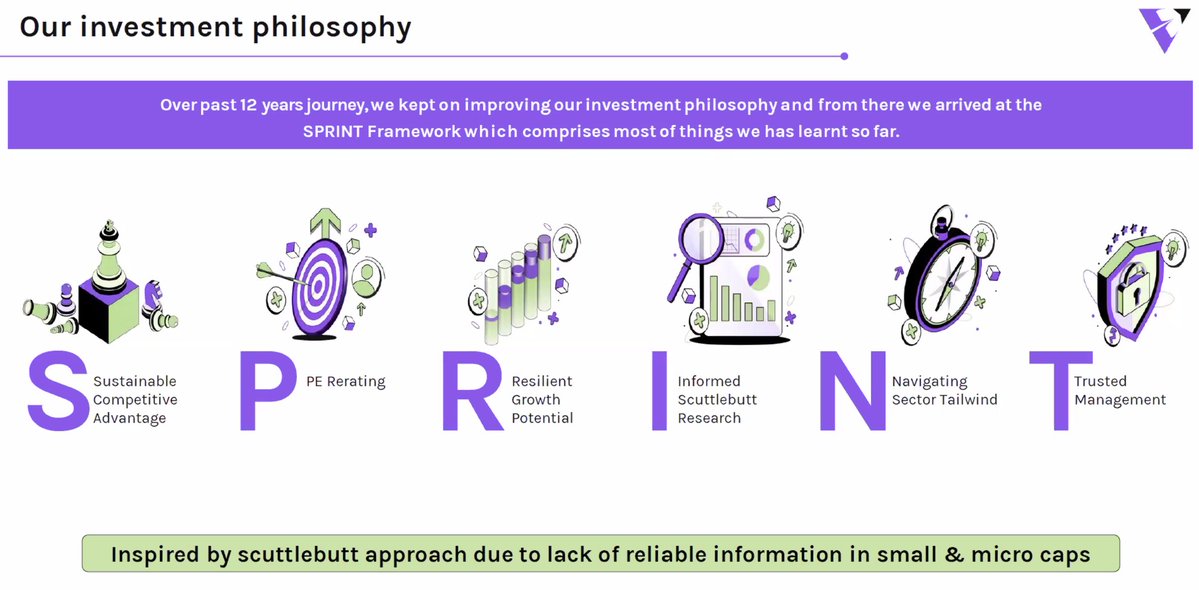

Their investment philosophy: SPRINT

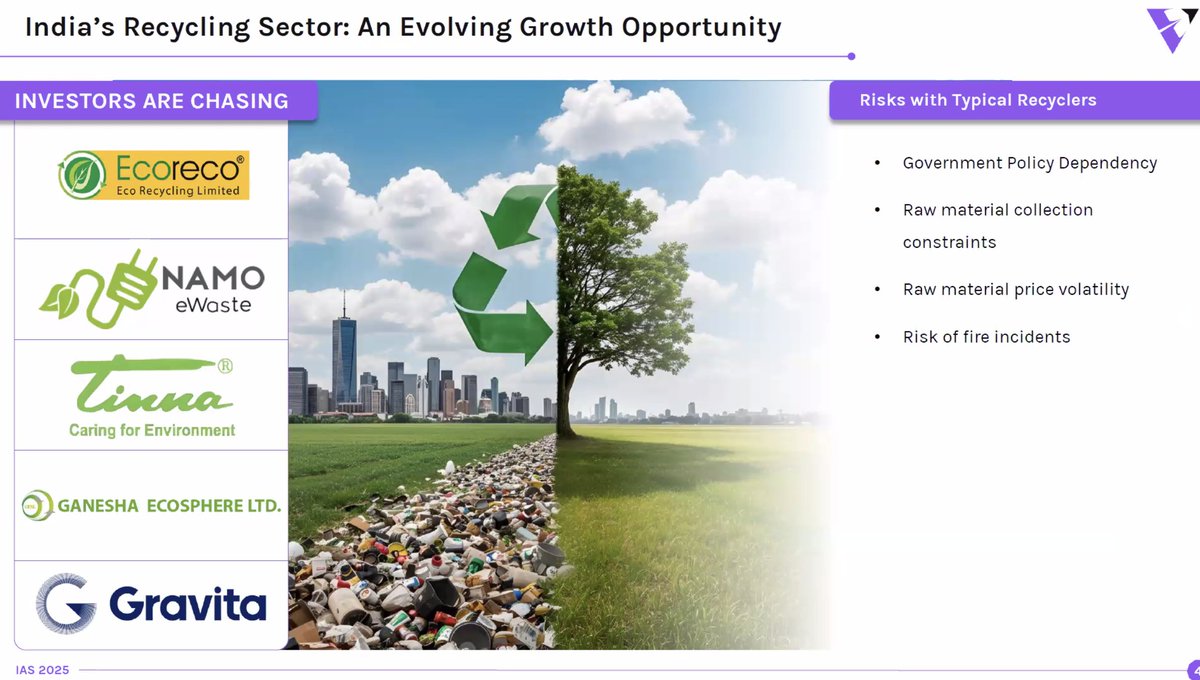

India's recycling sector: An evolving growth opportunity Companies: Ecoreco, Namo E Waste, Tinna Rubber, Ganesha Ecosphere, Gravita. Risk: Government Policy dependency, RM Collection constraints & price volatility.

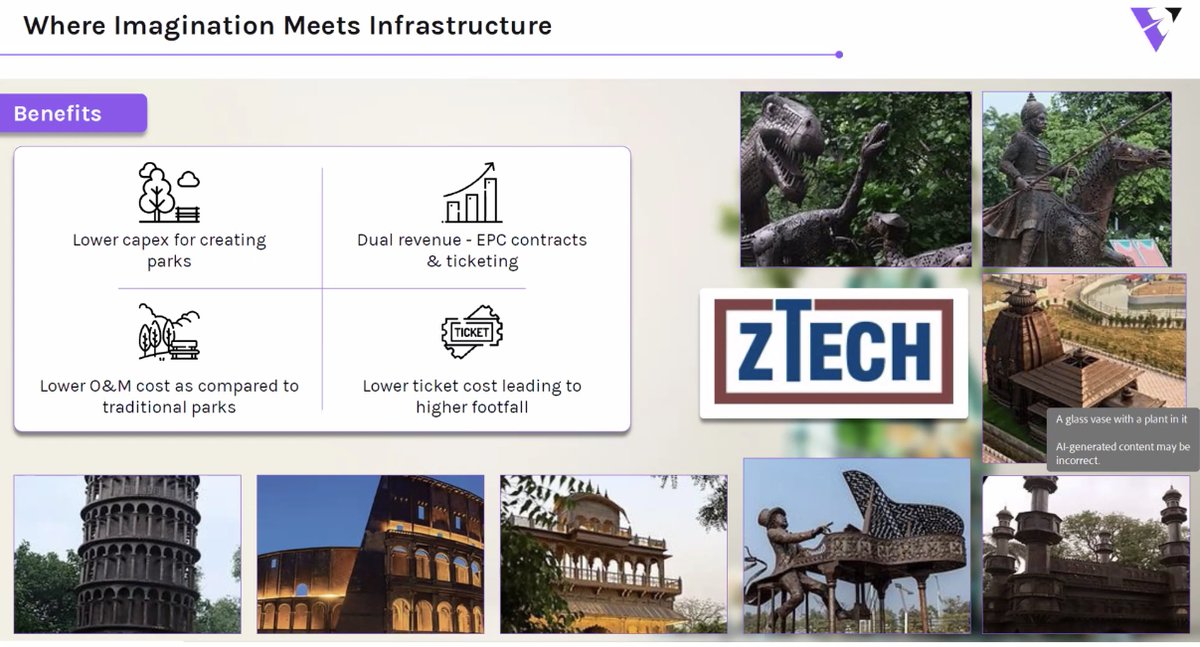

Business Model: Creating the middle layer of mass entertainment i.e. accessible waste to art theme parks, somewhere in between government parks & Wonderla/Imagica. Ticket Cost: 50-100 Rs

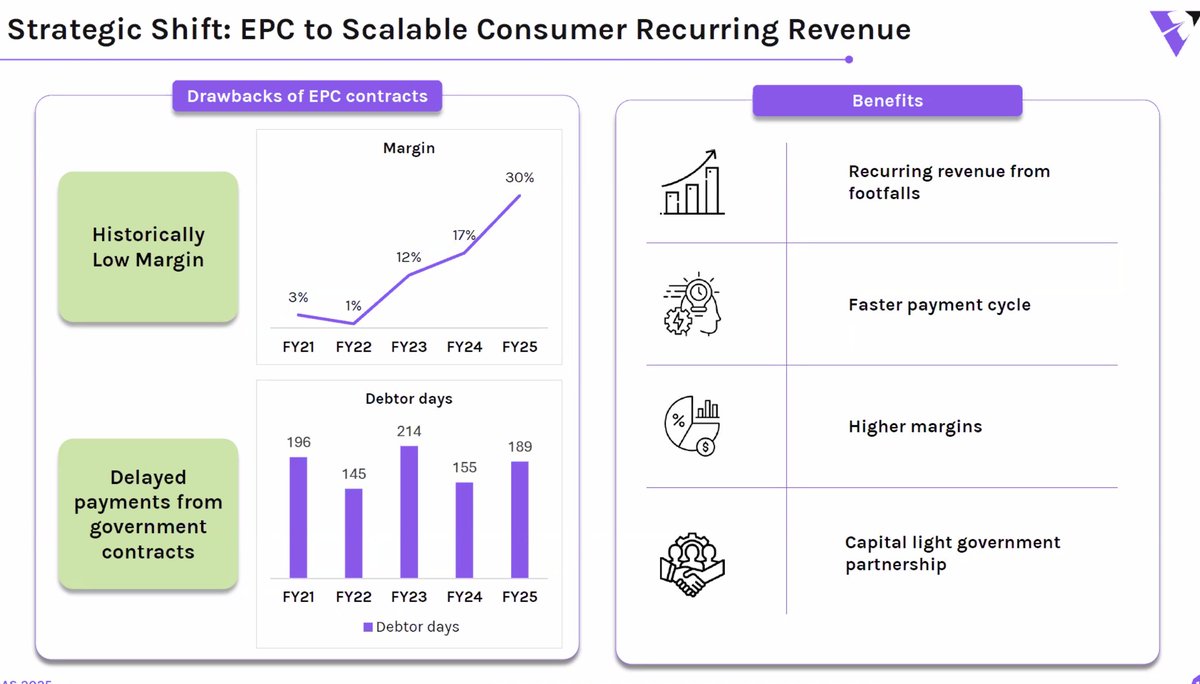

Business Segments: 1. Theme Parks (Zing Creative Parks) - Strategic shift from EPC to scalable consumer recurring revenue(High margins, affordable pricing, High daily footfalls, Recurring cash flow) 2. Geotechnical Solutions 3. GEIST waste water treatment

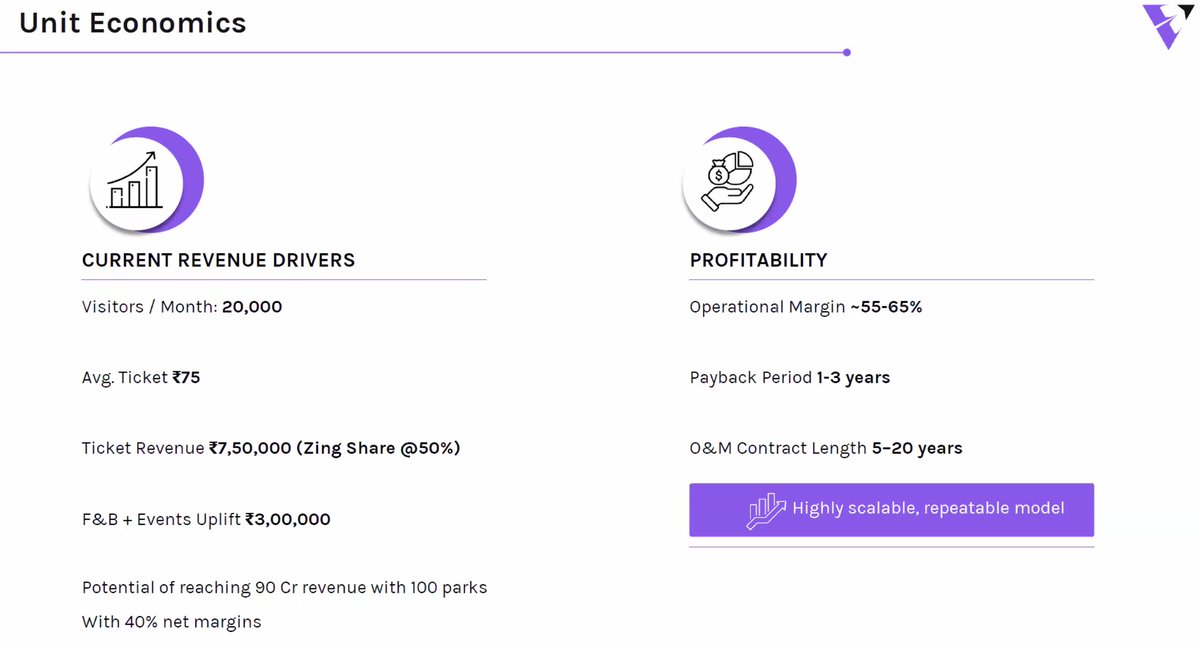

Unit Economics of theme parks FY26: Targeting 15 operational parks by end of FY26 Next 3 years targeting 100 parks. Disc: No recommendation

~unroll~ We have earlier covered Z-tech business in our first substack which is attached below which is very much detailed. Hope you like the same, Share & follow to support your investor friedns & compounding knowledge! Disc: Invested & biased