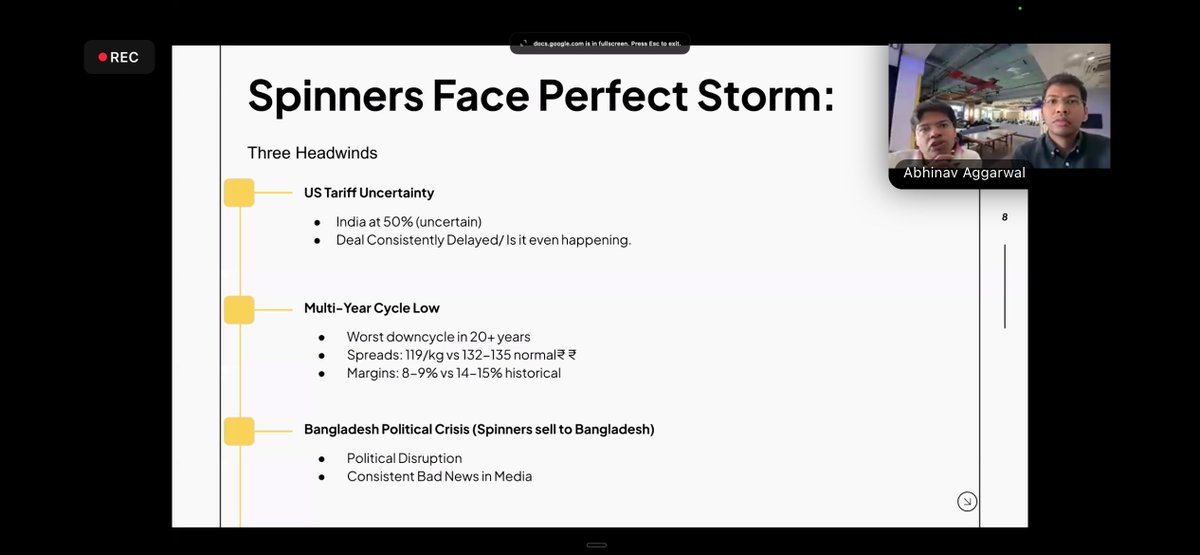

Cycles Create Opportunities Textiles today sit deep in a 2.5-year downcycle - precisely when most people stop looking. That’s usually when long-term opportunity starts forming.

Why sentiment is so poor: • US tariff uncertainty • Worst spinning downcycle in 20+ years • Margins compressed to 8–9% vs 14–15% historical • Bangladesh political noise hitting exports

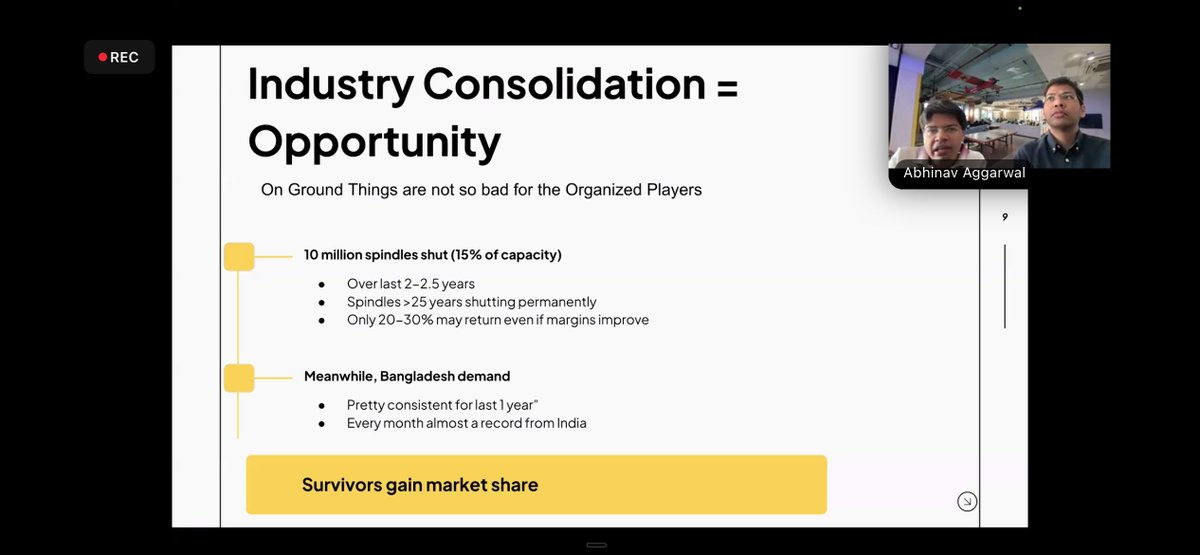

Industry Consolidation and Multiple Positive Catalysts Over the last 2–2.5 years, ~10 mn spindles (~15% capacity) shut, inefficient mills exited While headlines stay negative, tailwinds are aligning: - India–UK FTA - India–EU talks - Cotton duty optionality

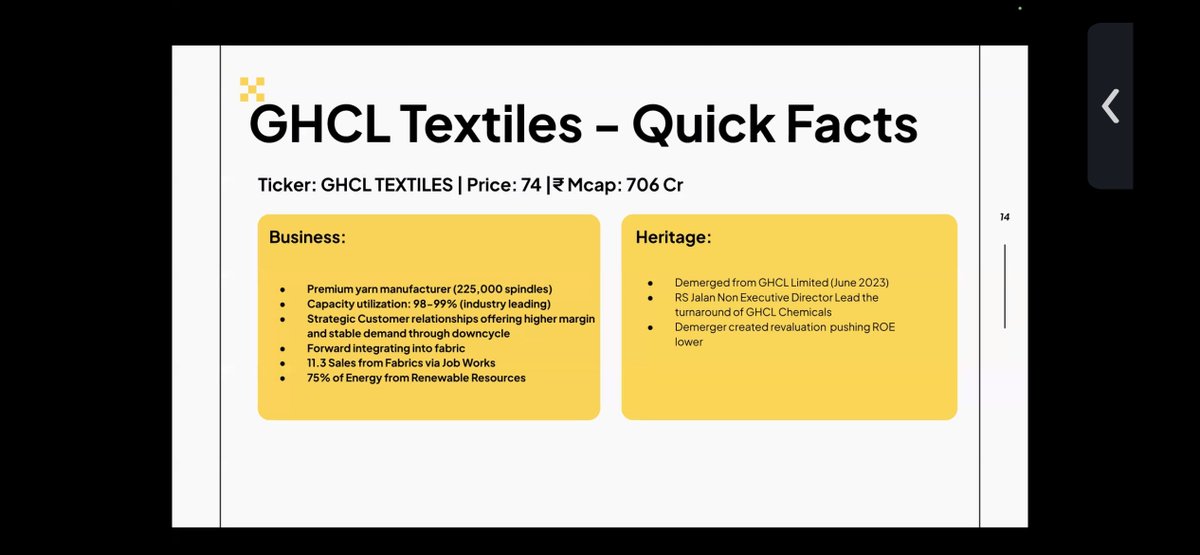

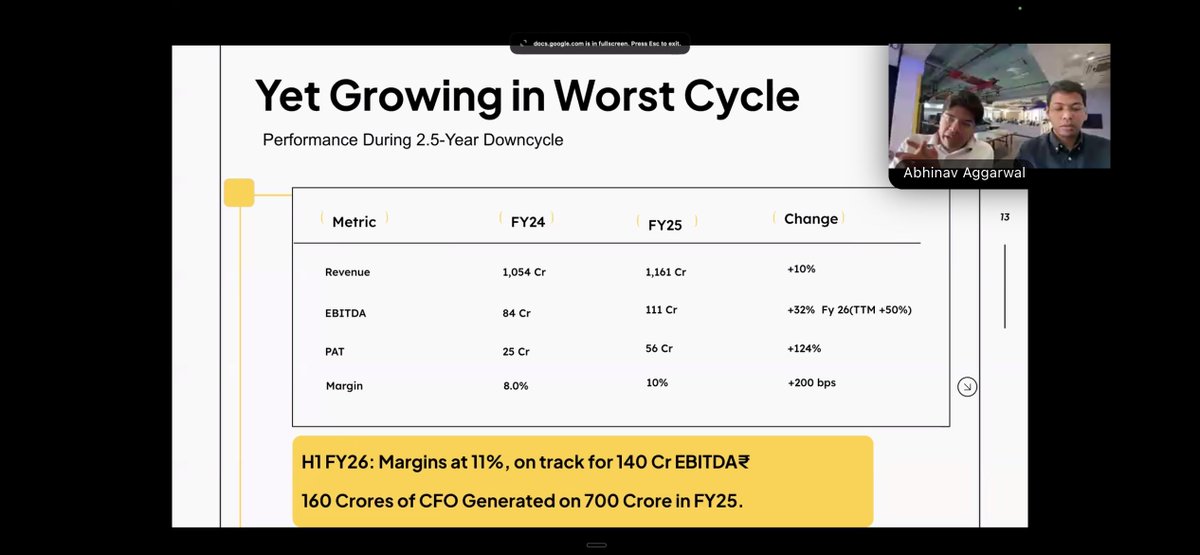

GHCL Textiles -demerger, not a stressed carve-out (speaker-highlighted) Key traits: • Premium yarn manufacturer (~225k spindles) • Strong customer rls through cycle • Forward integration into fabric underway Even in the downcycle: • Revenue +10% • EBITDA +32% • Margins+2%

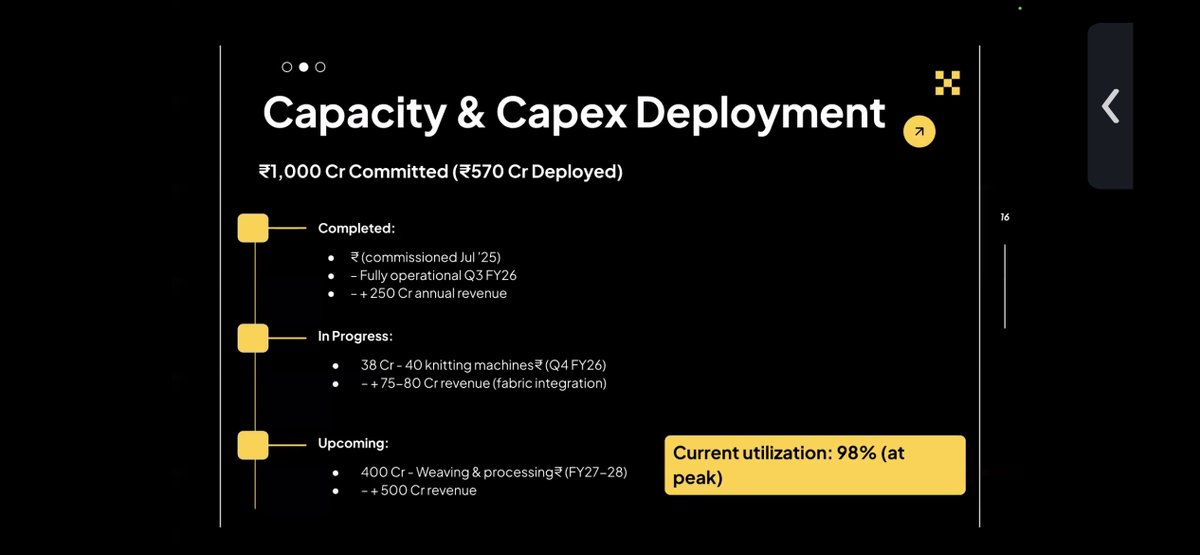

Capacity and Capex Deployment Plan ₹1,000 cr committed: • ₹570 cr already deployed • Spinning expansion operational • Knitting & fabric integration underway • Weaving & processing planned next Current utilisation: ~98% — growth needs capacity.

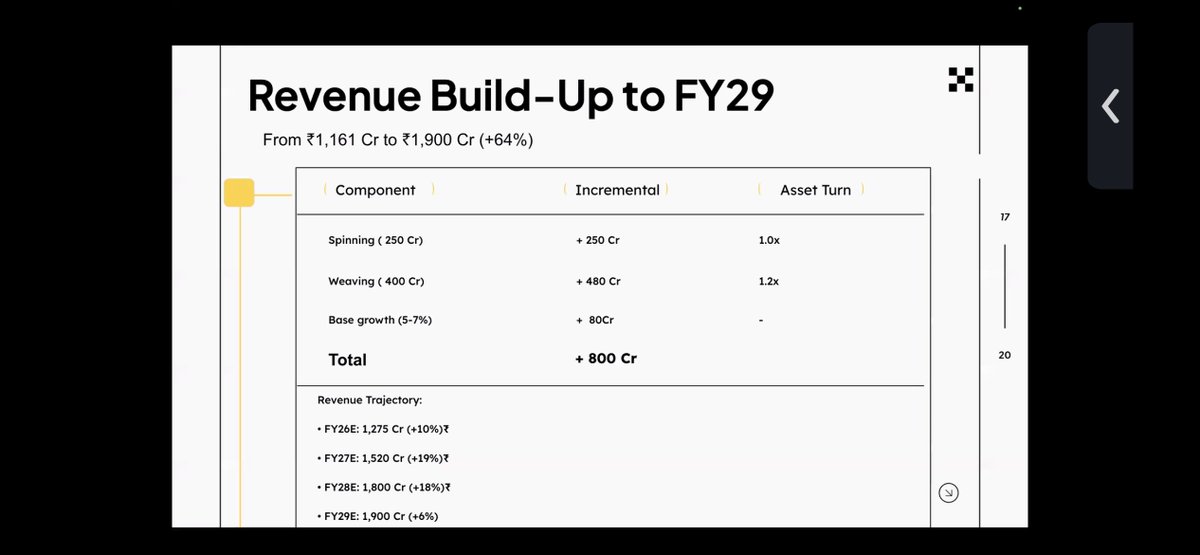

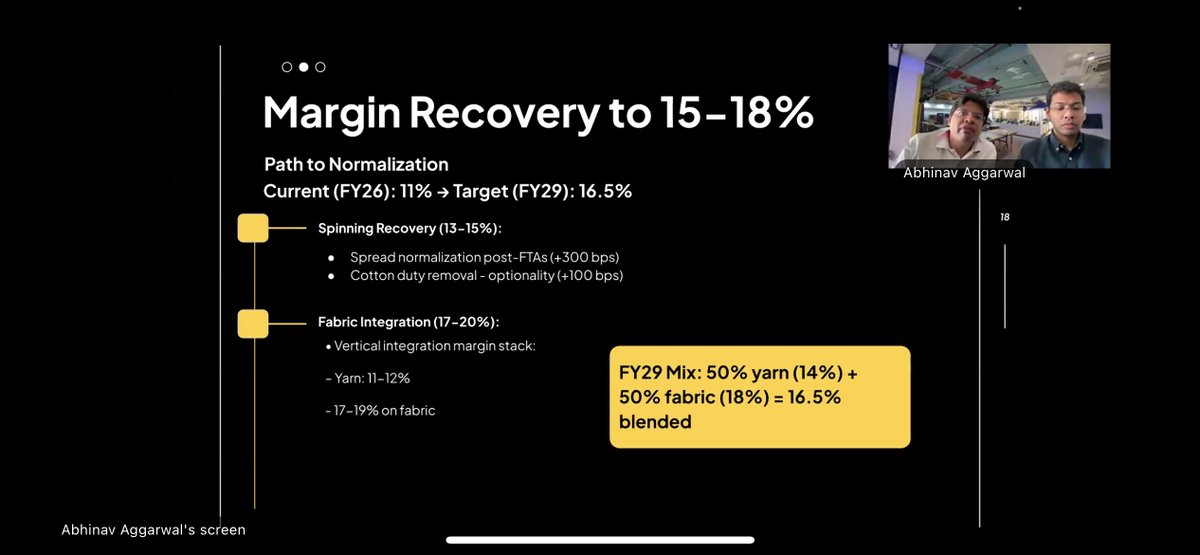

Revenue growth here : Sales can move from ₹1,161 cr to ~₹1,900 cr by FY29 simply through added capacity And margins when the cycle turns: spinning can recover to 13–15%, fabric integration to 17–20%, can take the blended margins to ~16.5%.

Driven by spinning normalization + fabric integration. EBITDA trajectory should follow a 2.2–2.6× EBITDA growth • FY26E: ₹142 cr • FY29E: ₹314 cr Though every business is not risk free: • Capex execution delays • Cotton price volatility • Competitive pressure

Not a straight-line story. It’s a cycle + consolidation + execution story. Put the pieces together: • EBITDA growth: ~2.2–2.5× • Multiple re-rating: ~5.5× → ~10× Math points to ~4–5× potential over 3 years if the cycle normalizes. Disc: No recommendation, do your own DD