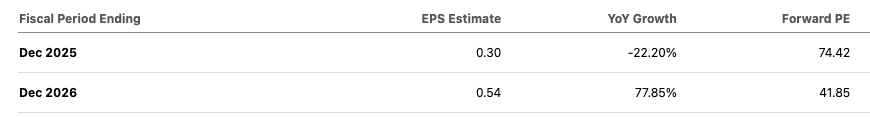

10)仍然被低估 儘管$SOFI在過去幾個月上漲了200%以上,但無論你信不信,它仍然被低估。舉個例子。 $SOFI目前的預期本益比約為74倍,但這是基於2025年每股收益0.30美元的預期,低於管理階層修訂後的0.31美元的指引。此外,分析師預計2026年每股收益為0.54美元,也低於管理階層0.55美元至0.80美元的指引。分析師忘記了,管理階層不僅喜歡敷衍了事地實現他們的指引,還會在過程中將其摧毀。話雖如此,我相信$SOFI在2026年的每股盈餘將達到1.00美元,以目前2026年預期本益比計算,SOFI的估值約為21倍。現在看來,這是一個不錯的估值。一些值得考慮的催化劑包括:- 貸款平台業務的新交易 - 收購 - 重新推出加密貨幣產品 - 降息

好了!如果您想閱讀我關於$SOFI的完整投資論文,請查看我的深入文章:https://t.co/H7iuGNqovQ。這些文章花費了我大量的時間和精力來撰寫,因此希望您能按讚、分享和訂閱。感謝您的支持!