Next Speaker of the Day in @ias_summit : Gaurav Agarwal @9onecapital Company Name : Creative Graphics Solutions India Ltd Market Cap: 479 Cr #IAS2025

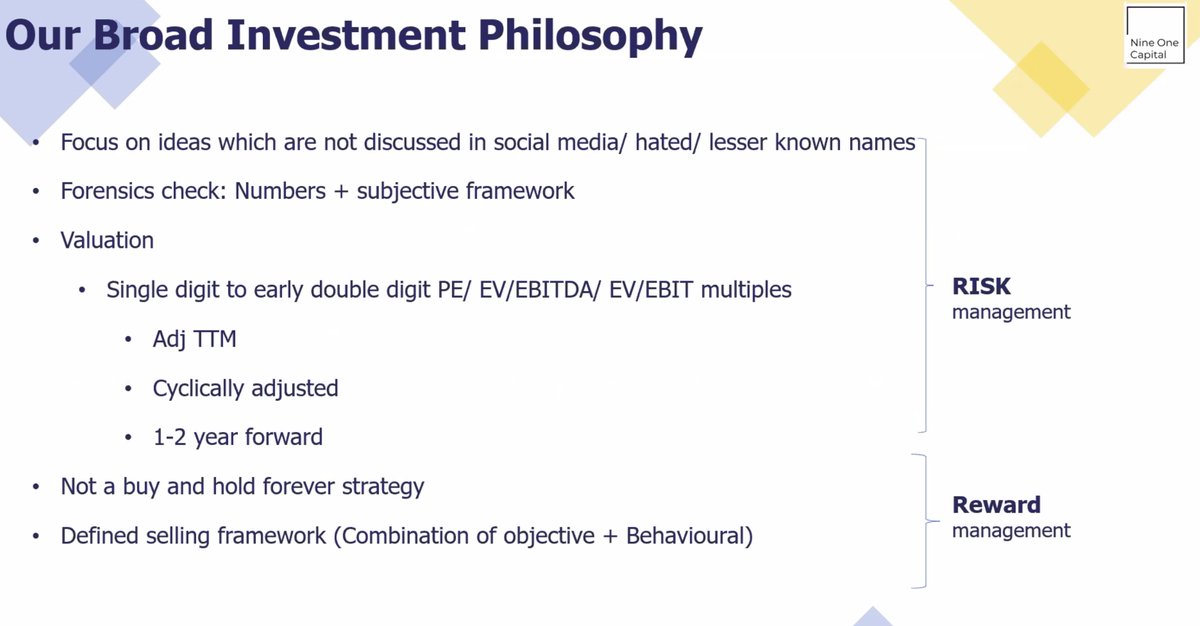

Nine One Capital Investment Philosophy

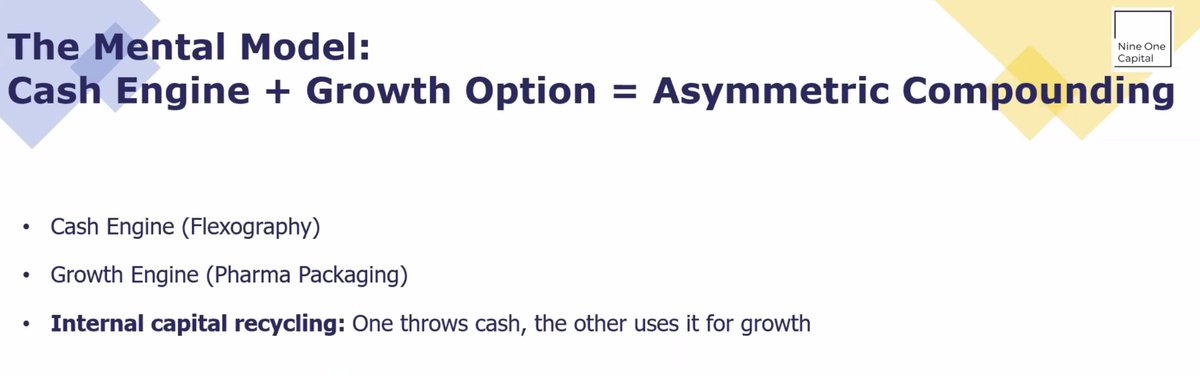

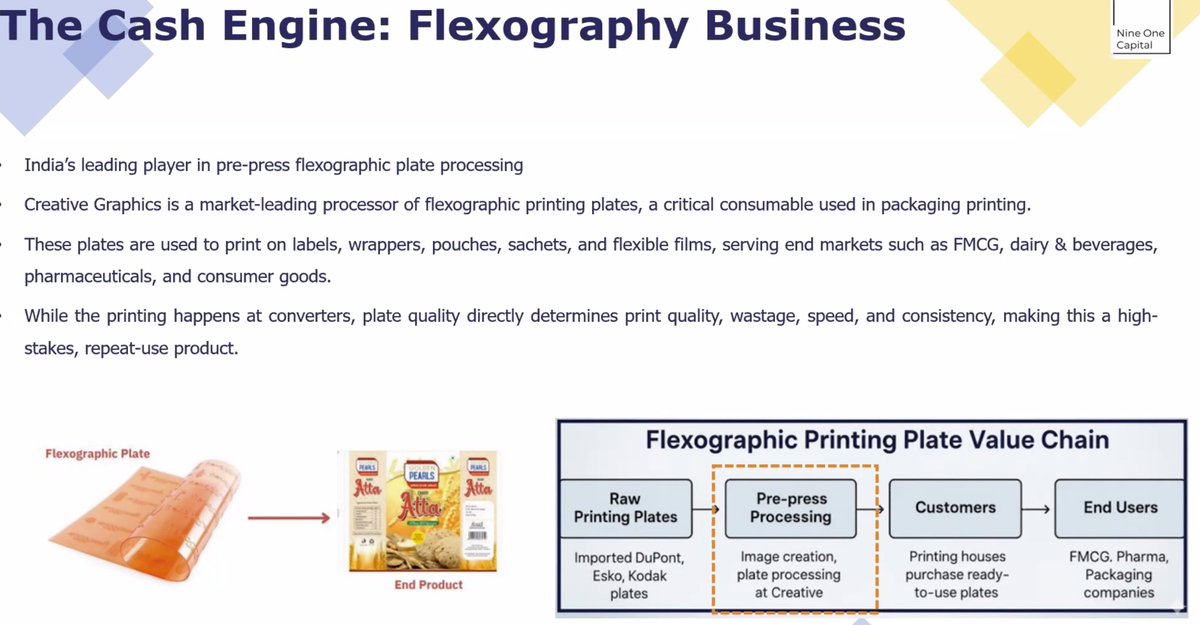

Creative Graphics has two segments. Flexography is the cash engine generating steady free cash flows, which are now being rotated into higher-margin segments, forming the next growth engine.

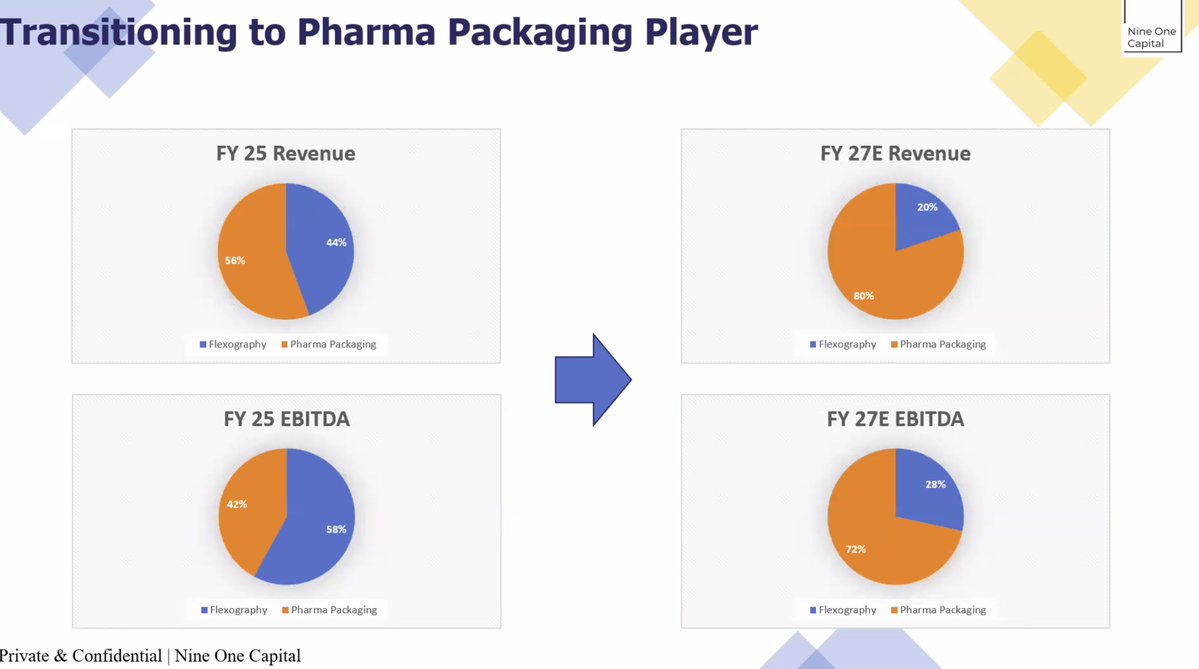

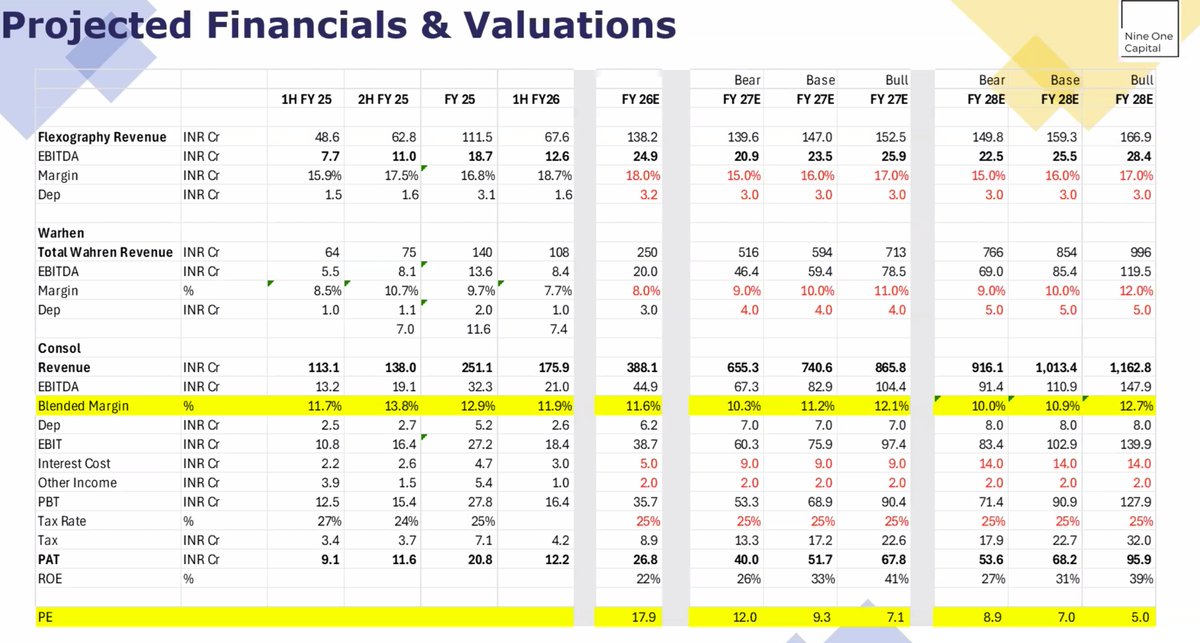

Flexography is the cash generator, but the mix is clearly shifting. FY25: 44% revenue / 58% EBITDA from flexo → by FY27E: ~20% revenue / ~28% EBITDA. Pharma packaging should becomes the dominant growth & margin engine.

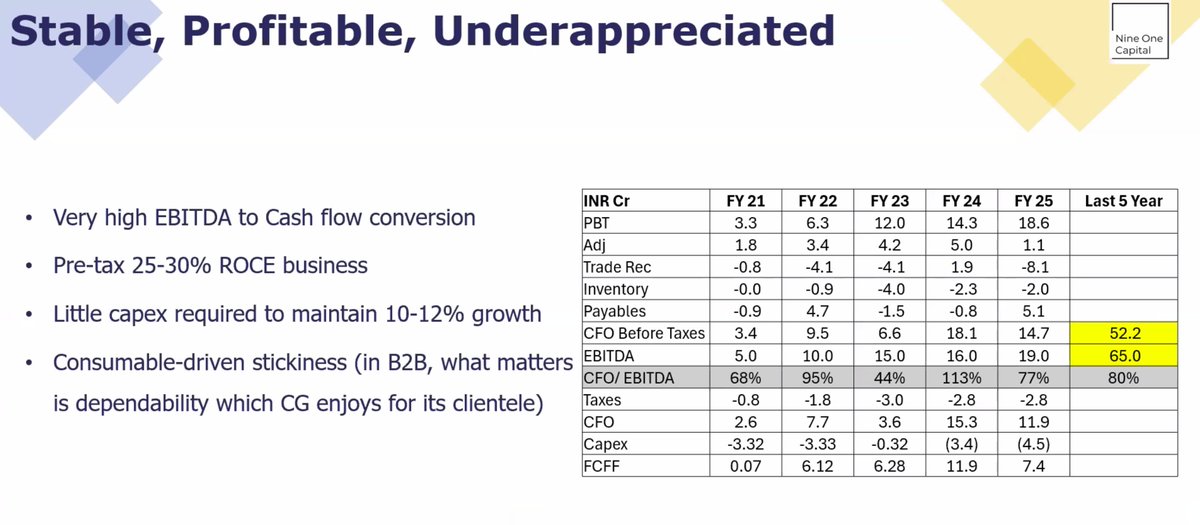

The cash engine: Driven by shift to higher-value, repeat-use consumables, strong pricing power, low capex needs, and ~80% EBITDA-to-CFO conversion. A quiet cash engine with ROCE discipline and sticky B2B demand.

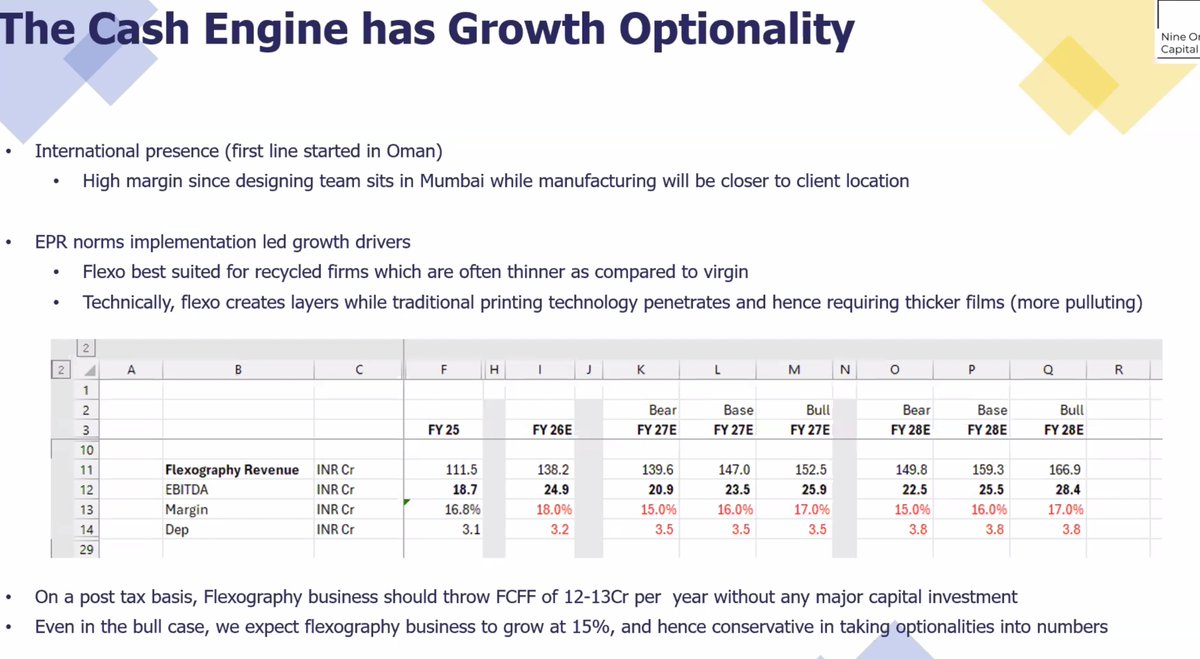

Flexography has clear optionality: international rollout (starting Oman), structural tailwinds from EPR norms, and flexo’s advantage in recycled packaging. Even conservatively, ~15% growth + ₹12–13 Cr annual FCFF with minimal capex.

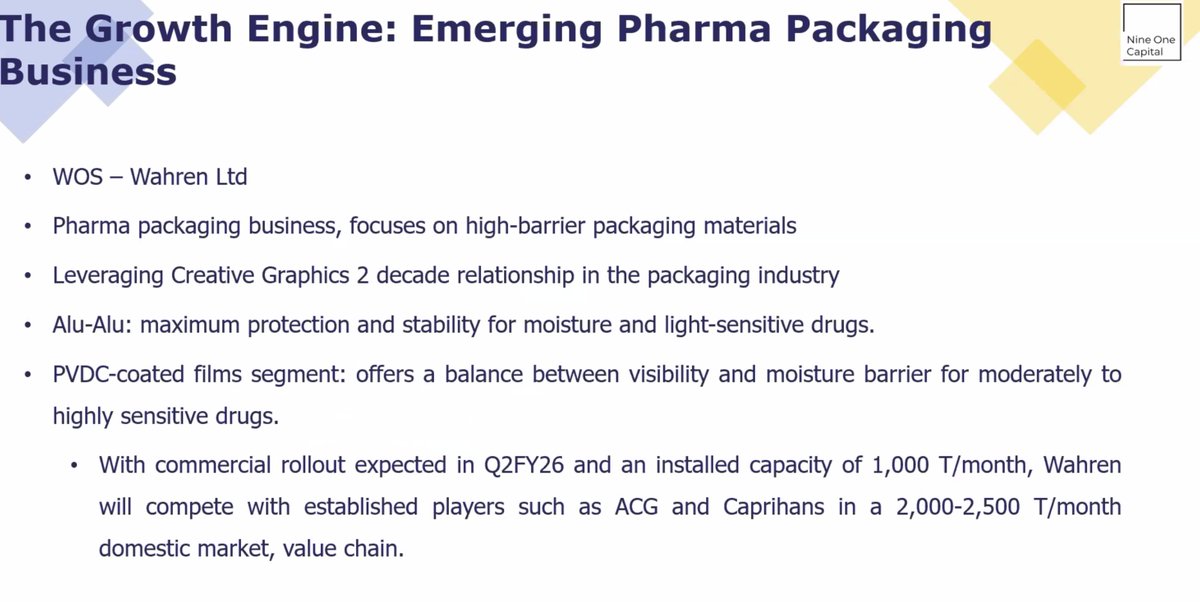

The growth engine - pharma packaging. Through Wahren , focus is on high-barrier formats (Alu-Alu, PVDC films) Commercial rollout from Q2FY26, with 1,000 T/month capacity, entering a high-entry-barrier market dominated by ACG & Caprihans.

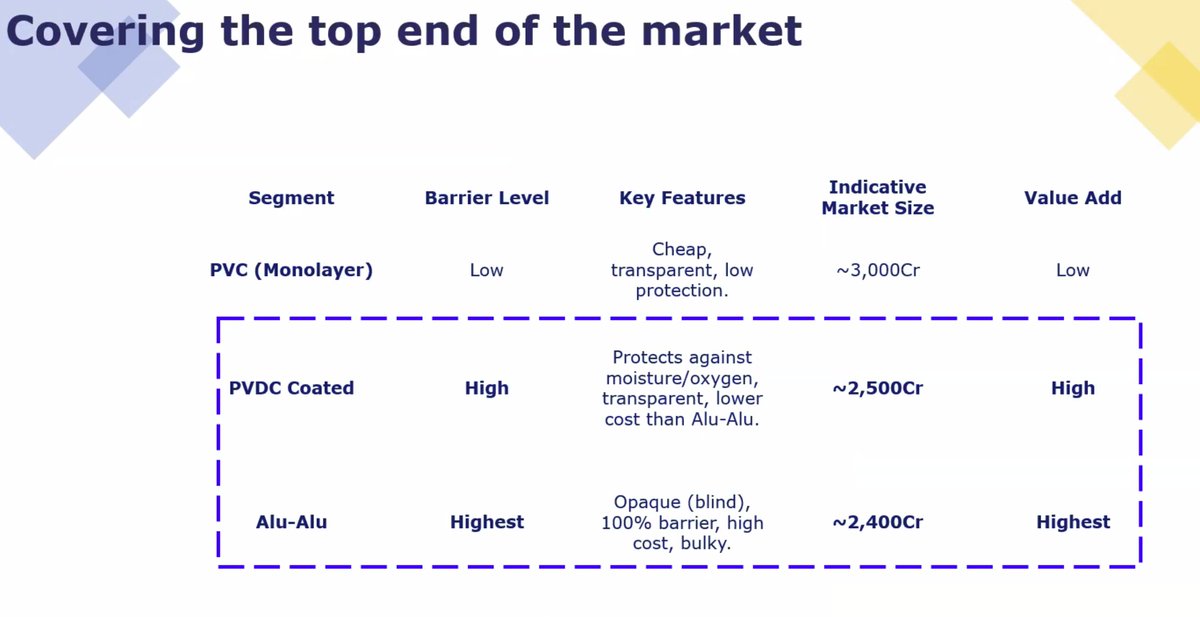

TAM of PVDC and Alu-Alu

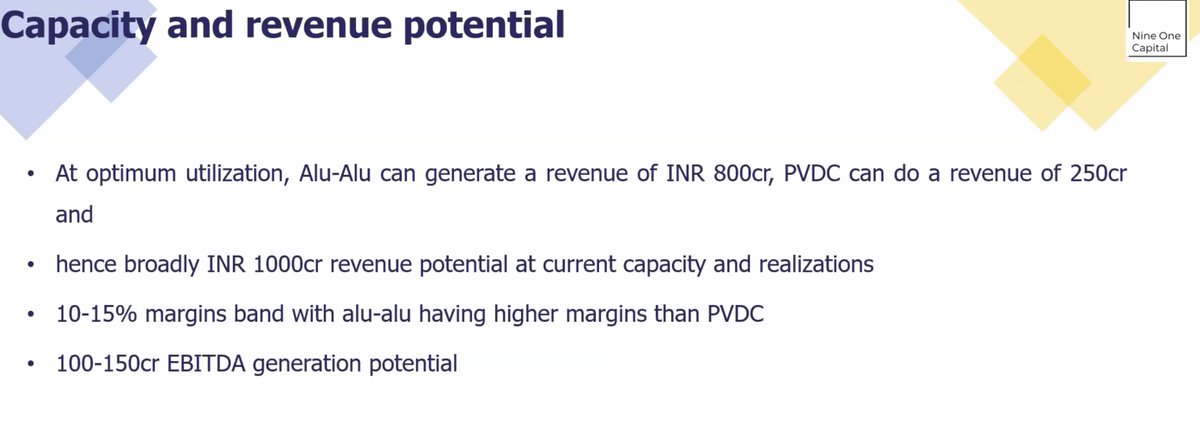

At optimal utilisation, Alu-Alu (~₹800cr) + PVDC (~₹250cr) together offer ~₹1,000cr revenue potential at current capacity. Margins in the 10–15% band (Alu-Alu higher), implying ₹100–150cr EBITDA potential. Clear upside as utilisation ramps.

Valuation Snapshot: With EBITDA compounding, mix shifting to higher-margin pharma packaging, and ROE moving >30%, valuation compresses fast if execution holds.

Key risks to track : • Execution & utilisation: Growth hinges on timely ramp-up of new capacities. • Working capital stress: ₹80–100cr funding need, likely debt-led. • Input & regulation: Raw material volatility, regulatory approvals, and rising competition could pressure